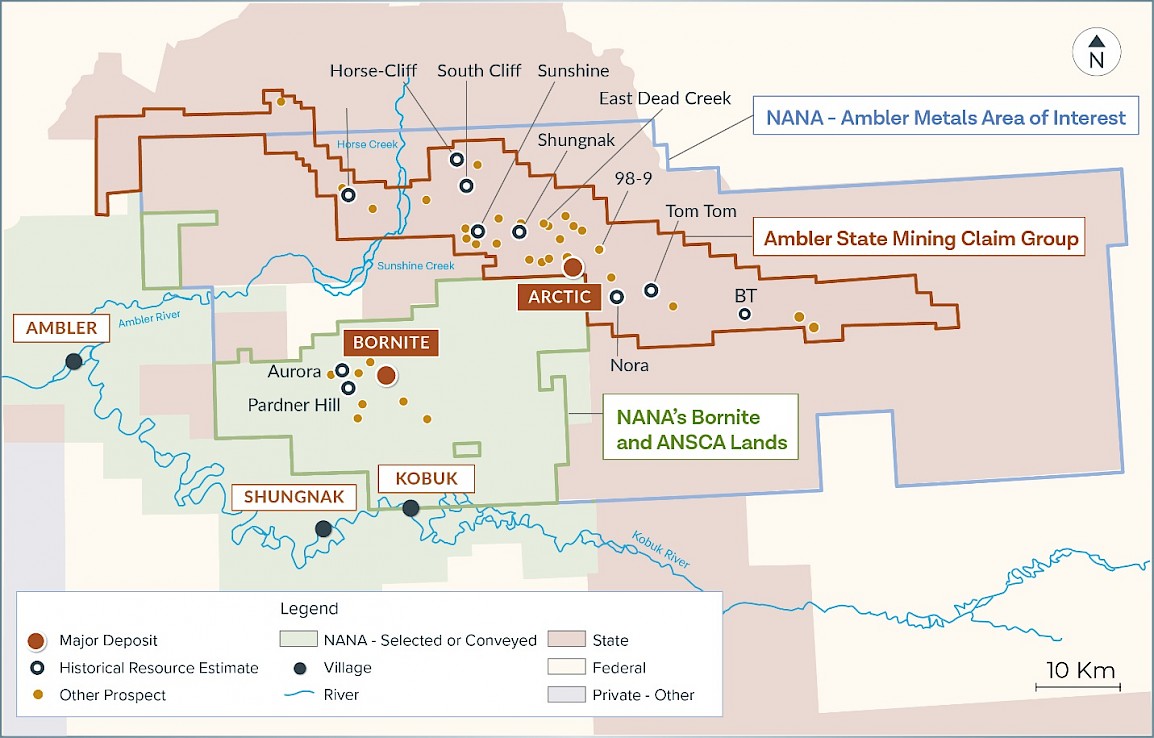

The Upper Kobuk Mineral Projects (“UKMP”) consists of a 471,796-acre land package containing state, patented and native lands within an area of interest. The two most advanced projects are the feasibility-stage Arctic copper-zinc-lead-gold-silver volcanogenic massive sulphide (“VMS”) project and the Bornite copper-cobalt carbonate replacement project.

The Upper Kobuk Mineral Projects (“UKMP”) consists of a 471,796-acre land package containing state, patented and native lands within an area of interest. The two most advanced projects are the feasibility-stage Arctic copper-zinc-lead-gold-silver volcanogenic massive sulphide (“VMS”) project and the Bornite copper-cobalt carbonate replacement project.

The Upper Kobuk Mineral Projects

In addition to Arctic and Bornite, the UKMP also hosts numerous other polymetallic mineral deposits and prospects such as Sunshine, South Cliff, Horse-Cliff, Snow, Nora, Tom Tom and BT. The formation of the joint venture with South32, in which South32 contributed $145 million into Ambler Metals, enables additional exploration activities with the goal of increasing the mineral inventory of the district.

The strategy of Trilogy and our Partners is to advance both the Arctic and Bornite projects into production while carrying out additional exploration in the search for high-grade deposits within the UKMP.

The UKMP: Key Facts

- It is an extensive 471,796-acre (190,929-hectare) land package that is over 60 miles long (100 km).

- Mineralization in the UKMP area is characterized by two discrete mineralized belts: the Devonian Ambler Schist Belt and the Devonian Bornite carbonate sequence.

- The Ambler Schist Belt hosts VMS deposits in bimodal Devonian volcanic and sedimentary rocks. A number of notable VMS deposits, including the Arctic, Dead Creek (Shungnak), Sunshine, Horse-Cliff, Sun, and Smucker deposits, occur in this belt.

- At Bornite, mineralization is hosted by Devonian clastic and carbonate sedimentary rocks lying immediately south of the Ambler Schist Belt across the Ambler lowlands.

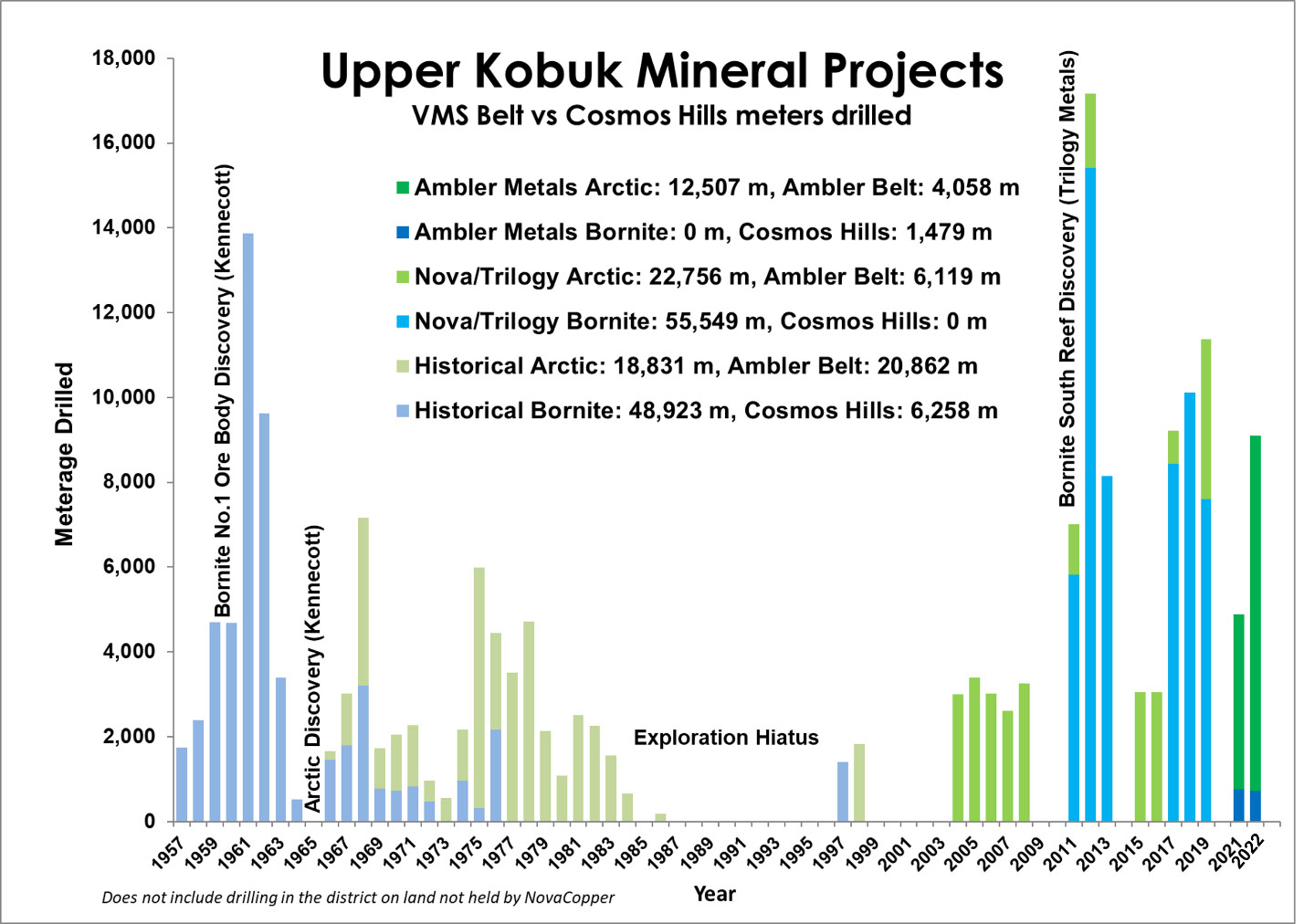

History

In 1947, local prospector Rhinehart “Rhiny” Berg along with various partners traversing in the area located outcropping mineralization along Ruby Creek (Bornite) on the north side of the Cosmos Hills. They subsequently staked claims over the Ruby Creek showings and constructed an airstrip for access. In 1957, BCMC, Kennecott’s exploration subsidiary, optioned the property from Berg. Kennecott (now Rio Tinto) carried out intermittent exploration work in the area.

On March 22, 2004, Alaska Gold Company, a wholly-owned subsidiary of NOVAGOLD Resources Inc. (NOVAGOLD) completed an Exploration and Option to Earn an Interest Agreement with Kennecott Exploration Company and Kennecott Arctic Company (collectively, Kennecott) on the Ambler land holdings.

On December 18, 2009, a Purchase and Termination Agreement was entered into between Alaska Gold Company and Kennecott whereby NOVAGOLD agreed to pay Kennecott a total purchase price of $29 million for a 100% interest in the Ambler land holdings, which included the Arctic Project, to be paid as: $5 million by issuing 931,098 NOVAGOLD shares, and two installments of $12 million each, due 12 months and 24 months from the closing date of January 7, 2010.

The NOVAGOLD shares were issued in January 2010, the first $12 million payment was made on January 7, 2011, and the second $12 million payment was made in advance on August 5, 2011; this terminated the March 22, 2004 exploration agreement between NOVAGOLD and Kennecott. Under the Purchase and Termination Agreement, the seller retained a 1% net smelter return (NSR) royalty that is purchasable at any time by the landowner for a one-time payment of $10 million.

During 2011, NOVAGOLD incorporated the Trilogy Metals entities and transferred its Ambler land holdings, including the Arctic Project from Alaska Gold Company to Trilogy Metals Inc. In April 2012, NOVAGOLD completed a spin-out of Trilogy Metals, with the Ambler lands, to the NOVAGOLD shareholders and made Trilogy Metals an independent company publicly-listed on the TSX and NYSE AMERICAN exchanges.