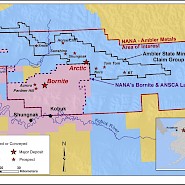

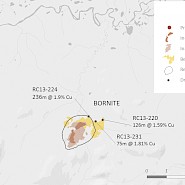

The project has the potential to further enhance the long-term economics of the Ambler mining district. Trilogy Metals announced the results of the Bornite Preliminary Economic Assessment (PEA) on January 15, 2025.

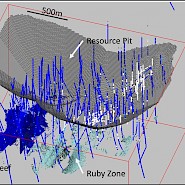

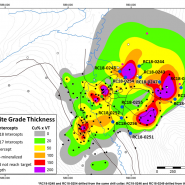

The Bornite PEA describes the technical and economic viability of establishing an underground mining operation for a 6,000 tonne-per-day operation with a 17-year mine life. The PEA assumes re-purposing the infrastructure described in Trilogy’s 2023 Feasibility Study for the Arctic Project for use with the Bornite Project once the Arctic deposit has been depleted. The PEA was prepared on a 100% ownership basis and all amounts are in US dollars.